To my international audience, I decided to re-write my previous post in English. All the theses are mine reflecting the ideas from the book below. (The link to the first chapter is found from right by clicking the word "täällä").

|

| Robert R. Prechter (2017) The Socionomic theory of finance. Socionomics institute press. Gainesville, Georgia USA. |

Out of love for the

truth and from desire to elucidate it the

following ten theses shall be discussed based on the Socionomics Theory:

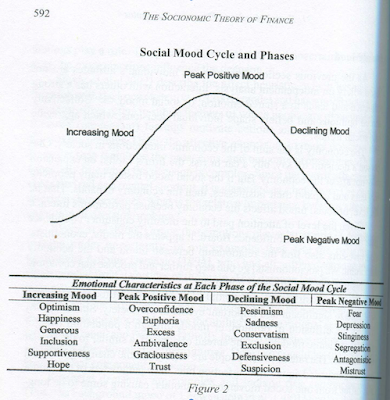

1. Social mood is a shared state of mind

that fluctuates in time dynamically between optimism and pessimism. In its

nature the social mood is endogenous, collective, pre-conscious and a-rational.

2. Since a-rational thinking

is connected to emotion, it differs qualitatively from rational and irrational

thinking. People who make a-rational life decisions base their actions on

intuition and conjecture, with little to no consideration or understanding of

the consequences.

3. The effects of one’s

actions are justified in hindsight to oneself and others. Thus the actions of

oneself and others involved are rationalized to their own benefit.

4. The social mood is

omnipresent in the society. An individual’s identity is never independent of

the surrounding time, place and culture; hence feelings, beliefs and attitudes

impact the actions of individuals and peoples.

5. Social mood dictates the

nature of political discussion, changes in attitudes and values and in a

broader scale it affects all aspects of human behaviour.

6. Since it is often left

unnoticed, social mood is also unremembered. This is why certain phenomena are

repeated time after time: “We learn from history that we do not learn from

history.” (G.W.F. Hegel)

7. Social mood is reflected

in the events, news and atmosphere of the society. Concretely it affects how we

spend our time, the things we believe in, as well as, the things that draw our

attention.

8. When social mood reaches

its peaks extreme events, phenomena and ideological attention seeking

increases. Similarly, as the trend starts its decline/increase, these phenomena

diminish.

9. New technology amplifies

the nature of the crowd society while providing an opportunity to use social

media as a means to advocate different schemes.

10. Social mood cannot be altered in crowds, but an

individual is able to learn and act unlike prevailing trends. This builds a

case for indirect, representative democracy based on an ideal of rational decision-making

and institutional distribution of power.

|

| Nofsinger, J, R. (2005). Social mood and financial economics. The Journal of behavioural finance 6:144-160. Reprinted with permission in the Socionomic Theory of Finance chapter 31: 585-618. |

Ei kommentteja:

Lähetä kommentti